As the accounting and finance industry continues to evolve, so do the challenges and opportunities that hiring managers face.

Finding and retaining top talent isn’t just another task on the to-do list—it’s a strategic necessity. Technology, flexible work models, and shifting workforce expectations are changing the way we hire, lead, and grow.

Let’s explore the latest trends shaping the accounting and finance workforce, and how you can adjust your hiring strategy to stay competitive.

Trend 1: Talent Retention Challenges

Consider this scenario: A highly skilled financial analyst, with a knack for data-driven insights, has been an asset to your organization for several years.

However, they’ve started to receive enticing offers from other companies who are implementing new AI and machine learning technologies—something your employee is very eager to work with. Intrigued, they agree to have a couple exploratory calls to discuss each opportunity in more detail.

Is your company well-positioned to retain them by offering similar opportunities or clarity on their growth path?

A Deloitte study confirms what many leaders already feel—retention pressure is still sky-high.

Data suggests that roughly half of accounting and finance professionals will leave for higher paying jobs. They’re not necessarily unhappy, but they are curious.

Nearly 8 in 10 hiring managers report losing skilled finance professionals to better offers, new technology environments, or more flexible workplaces.

Today’s professionals want more than a paycheck. They’re looking for meaningful work, career development, modern tools, and yes: better work-life balance.

Trend 2: Technology Is Driving Change (And Competition)

New data from PwC shows that 58% of CFOs are increasing their investments in automation, AI, and analytics—not just to cut costs, but to stay attractive to tech-savvy talent.

The data supports it:

- 58% of CFOs are ramping up tech spend to boost efficiency and accuracy.

- Nearly all (96%) say technology plays a pivotal role in both employee retention and recruitment.

- A real-time close isn’t a dream anymore. Companies are actively implementing it, thanks to intelligent automation and better ERP integrations.

AI and automation are also reshaping job expectations. Algorithms now analyze massive data sets in seconds, allowing finance teams to focus more on insight and strategy than spreadsheets and data cleanup.

The “Touchless Close,” once a futuristic concept, is becoming standard—minimizing human intervention and reducing end-of-month fatigue.

But remember: automation doesn’t mean elimination. It’s about elevating your team’s value, not replacing it.

Trend 3: Remote and Hybrid Work Is Here to Stay

The pandemic may have introduced it, but employee preferences have cemented it: remote and hybrid work are the new norm for accounting and finance professionals.

Preferences have shifted—and the numbers tell the story.

Around 65% of professionals prefer a hybrid setup, while one-third would choose fully remote if they could. More than half say they’d change jobs for greater flexibility, and just 1 in 5 still prefer being in the office full-time.

For hiring managers, this means flexibility isn’t just a perk—it’s a competitive edge.

Remote work expands your candidate pool. Hybrid work boosts morale and retention. And employers willing to evolve their approach to productivity and trust can reap serious long-term benefits.

Trend 4: ESG Reporting Gains Momentum

ESG reporting—short for Environmental, Social, and Governance—tracks how a company handles everything from sustainability to ethics to community impact.

As these metrics become a bigger part of corporate reporting, finance professionals are being asked to integrate non-financial data into financial storytelling.

This shift is creating demand for candidates with broader expertise—think sustainability reporting, stakeholder analysis, and cross-department collaboration.

It’s no longer just about the numbers; it’s about the impact behind them.

Addressing Key Hiring Challenges with Smart Solutions

While the industry embraces these trends, challenges persist. By proactively addressing these concerns, your organization can create a work environment that attracts and retains top talent while fostering employee well-being and productivity.

Balancing Automation with Human Value

Technology is moving fast, but it still can’t replace human intuition, strategic thinking, or nuanced decision-making.

The key isn’t replacing your team, it’s empowering them to do higher-value work. That means helping your finance professionals shift from manual tasks to more strategic roles.

What You Can Do: Focus on upskilling your workforce with training in data analysis, AI tools, and digital finance systems. Clarify how each role contributes to business strategy in a tech-driven environment so employees understand the value they bring beyond the spreadsheet.

Skills Gap

The accounting and finance world is changing faster than traditional training can keep up. As companies adopt AI, automation, and ESG reporting, many professionals are playing catch-up—creating a noticeable skills gap.

What You Can Do: Build a proactive talent development plan that goes beyond onboarding. Invest in continuous training and mentorship, and if possible, collaborate with colleges or training programs to help shape the next generation of tech-savvy finance professionals.

Burnout Mitigation

Even with new tools designed to make life easier, the pressure in accounting and finance hasn’t let up…especially during tax season or year-end crunch time.

As teams take on new technologies and processes, they may find themselves stretched thinner than ever.

What You Can Do: Support your team with a flexible work culture, practical mental health resources, and clear boundaries around time off. Smart workload management (yes, even spreadsheets have limits) can help your leaders keep an eye on employee well-being—and intervene before burnout leads to turnover.

Boost Your Hiring Strategy with Accounting and Finance Recruiters

Hiring the right talent has never been more competitive or critical. That’s why accounting and finance recruiters still matter.

A recruiter with deep industry insight (and access to a constantly refreshed candidate pipeline) can help you:

- Identify the best-fit professionals faster

- Reduce time-to-hire

- Stay current on competitive benchmarks

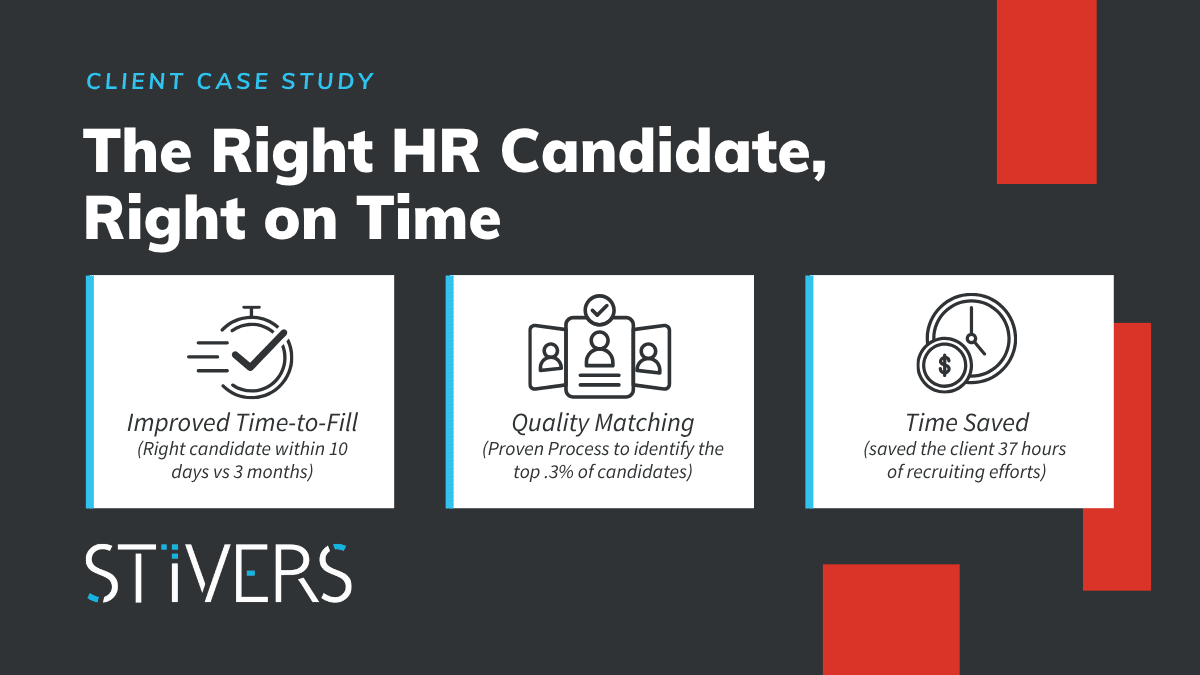

At Stivers, we combine proven processes with smart tech, including AI-driven tools and chatbot-enabled candidate screening.

Only 13% of candidates make it through our vetting process. That’s how we achieve a 97% retention rate for direct-hire placements.

With hundreds of candidate conversations happening in real time, our recruiters can identify top contenders for your roles quickly and confidently.

Blending human insight and technological efficiency ensures that you get the best of both worlds.

Let’s Build Your Future Workforce, Together

The accounting and finance space is transforming fast. Hiring managers who stay ahead of the trends—talent expectations, tech innovations, and remote work dynamics—are the ones who will build more agile, engaged, and future-ready teams.

Whether you’re trying to retain key talent or hire for newly evolving roles, Stivers has the people, the tools, and the expertise to help you succeed.

Let’s connect and build a smarter, stronger finance team.